Using an ESOP and 401(k) Plan as a Powerful Exit Strategy for Business Owners

One of the most effective yet often overlooked strategies involves combining an Employee Stock Ownership Plan (ESOP) with a 401(k)

Transform Your Financial Future with our

401(k) & 403(b) Solutions

Transform Your Financial Future with our

401(k) & 403(b) Solutions

“401k Funds Monitor has been a game-changer for my retirement planning as a busy physician. Their proactive approach in actively overseeing my 401(k) funds provided me with valuable insights and peace of mind. The tools and recommendations offered allowed me to make informed decisions about my investments, even in my hectic schedule.

Their personalized service and expert guidance ensured that I maximized my retirement savings efficiently. I highly recommend 401k Funds Monitor to any fellow healthcare professional looking for a reliable partner in securing their financial future.”

One of the most effective yet often overlooked strategies involves combining an Employee Stock Ownership Plan (ESOP) with a 401(k)

Life insurance is one of the most critical financial tools for protecting your loved ones in case of an untimely

Many employees sign up for their 401(k) plans and never think about them again—especially when it comes to updating their

Life insurance is one of the most critical components of a solid financial plan. It provides security for your loved

In times of financial stress, your 401(k) might seem like a lifeline—but is dipping into your retirement savings really the

This week, the SPY ETF reached a new all-time high, closing at $609.70 (+1.47%). After an initial drop on the CPI announcement, it

Stock markets tumbled globally on Monday after former President Donald Trump announced sweeping tariffs targeting key U.S. trading partners, reigniting

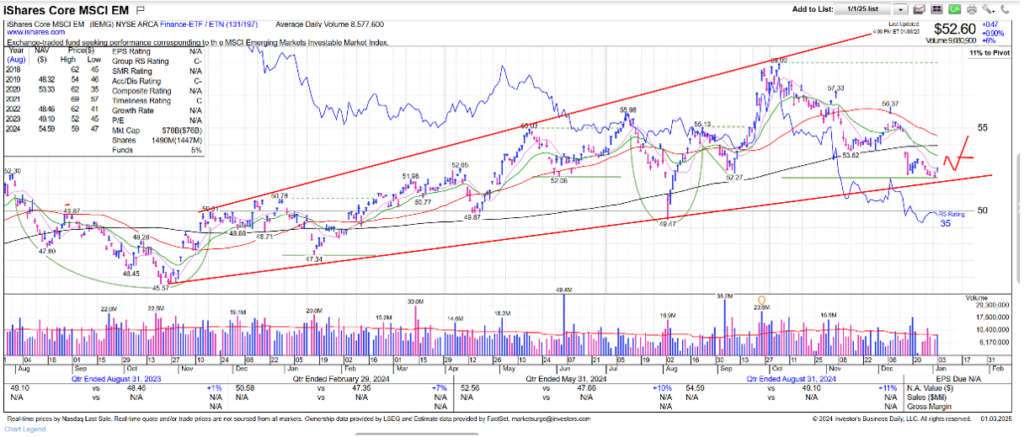

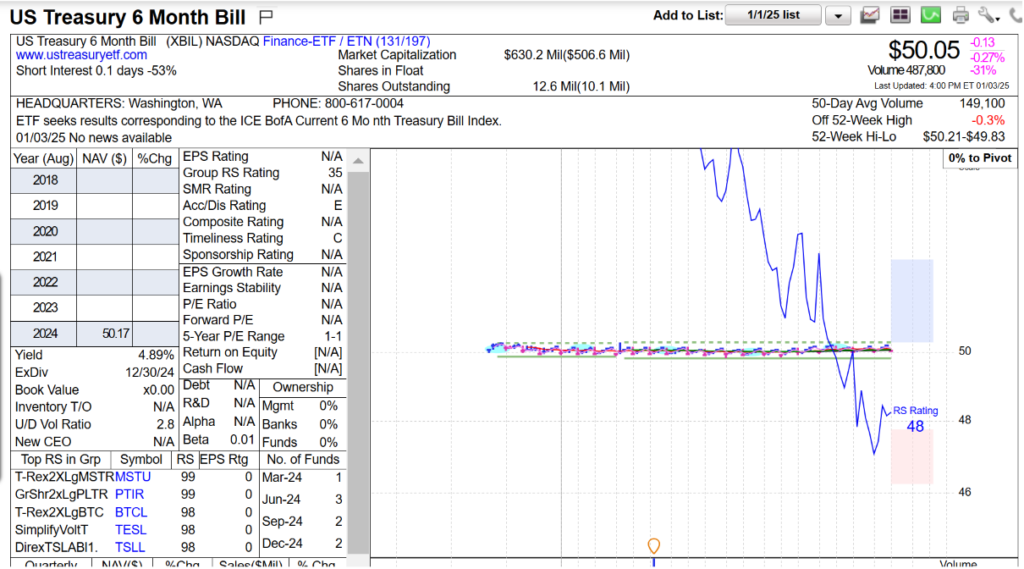

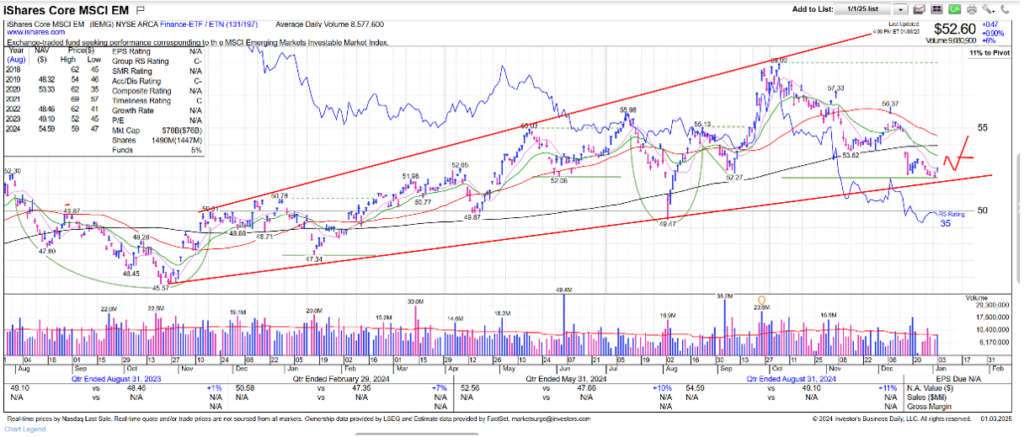

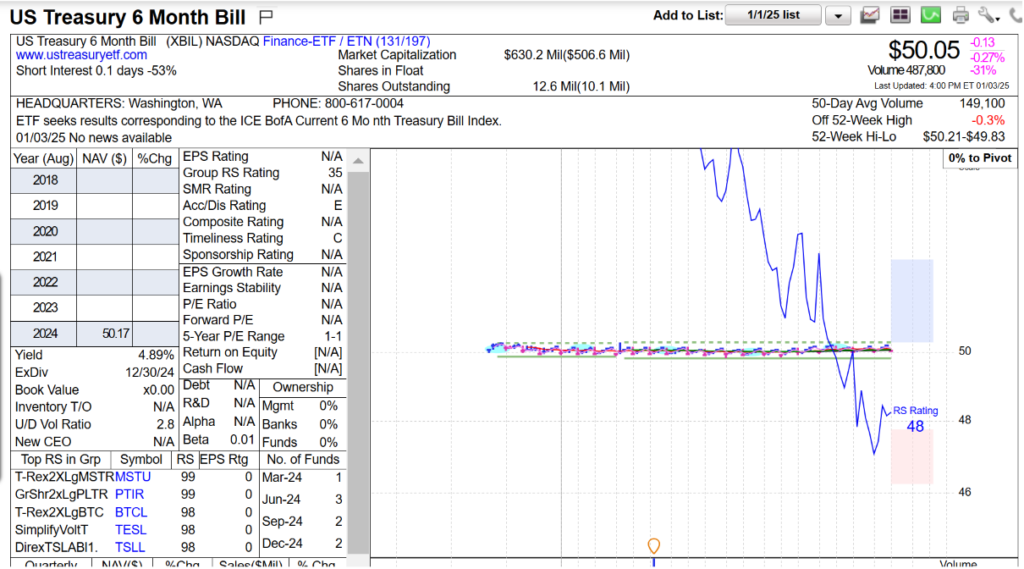

Chart Above– left intraday chart on 30min bars – red line is 5 day moving average line increasing, buy alert

Today, the Federal Reserve’s Federal Open Market Committee (FOMC) met to discuss interest rates and the overall state of the

The SPY, which represents the S&P 500 index, demonstrated resilience today despite market pressures. As of the close, SPY finished

We're here for YOU, actively monitoring your retirement funds with our CFP® professionals. Break free from plans with limited support - contact us for personalized, focused guidance.

We believe one image can outshine a thousand words, especially when it comes to understanding fund selection, performance, and projections. Dive into clarity with our Funds Chart.

Maximize tax advantages, leverage employer matches, and make savvy investment choices. We guide you to learn, adapt, thrive through market shifts, and secure a vibrant retirement—your journey starts here.

Unlock the secrets of your financial health with our expert analysis of Balance Sheets, Income Statements, and Cash Flow Reports. Track your wealth journey, make informed decisions, and secure your future.

Shield your financial future from life's surprises with our tailored insurance solutions. Plus, navigate the complexities of estate planning to pass on your wealth seamlessly. Start planning today!

Empower your investment journey with our top-notch tools. We will keep tabs on your 401(k) growth, analyze market trends, and ensure your investments are on the right path. Get started today!

Embark on a journey to financial mastery with us. Learn the ropes, engage with experts, plan your wealth, track your progress, and celebrate your success. Your path to financial prosperity starts here!

A game-changing guide that empowers you to take control of your retirement future. This insightful book offers a perfect blend of historical context, hard-hitting truths, and practical strategies to supercharge your 401k account. Kerkez, a Certified Financial Planner, demystifies the complexities of retirement planning with clear explanations and eye-opening charts, providing you with the knowledge to make informed decisions. Whether you’re just starting your career or nearing retirement, “401k Me Up” equips you with the tools to optimize your investments, avoid common pitfalls, and secure a comfortable future.

Learn valuable information on how to choose and track your 401(k) investments with resources designed to help you make smart investment decisions.

Guidance and management of your employer-sponsored retirement plan keeping same carrier/custodian, ensuring you're making the most of your workplace benefits.

Strategic management of employer stock within your 401(k), balancing potential growth with necessary diversification to protect your wealth.

Seamless assistance in transferring your 401(k) to an IRA or new plan when you leave your job, preserving and potentially growing your hard-earned savings.

Discover tailored strategies, resources, and expert insights to optimize your Solo 401k and master financial planning for your small business success.

Explore strategies and resources designed for HR Directors and 401k Plan Administrators to enhance employee benefits and drive financial wellness across your organization.

Offer your team expert-led seminars to enhance financial literacy, promote well-being, and foster a culture of financial wellness in the workplace..

Dive into a wealth of resources, including educational videos, real-world examples, and trusted tools to help you navigate financial planning with confidence..

Unlock a comprehensive library of videos, strategies, and practical examples to help you master the art of managing and growing your investments effectively

Access essential resources, expert advice, and practical tools to safeguard your future with effective risk management and insurance strategies

Discover essential guides, expert insights, and practical tools to help you secure your assets and create a lasting legacy for your loved ones.

We would love to speak with you.

Feel free to reach out using the below details.